-

How do I join FIR?

Joining FIR has never been easier! Start by filling out our online form . We’d be happy to start the process with you!

-

How can I open a new account?

If you already have a membership and you want to open an additional chequing, savings, term, RRSP or TFSA account, you can simply login to Online Banking and click the ‘Open New Products’ tab. You can also easily open accounts at any one of our advice centres .

-

What kind of ID do I need to open an account?

To open a membership, you’ll need one piece of valid (not expired) government-issued photo identification. Here’s a few examples of IDs that will work perfectly:

- government-issued driver’s license

- Indian status and identification card

- government-issued provincial ID card

- passport

If photo ID is unavailable, we can discuss other solutions.

-

Is there a fee to switch my account to FIR?

Switching to FIR is absolutely free!

-

How do I switch my direct deposits and automatic payments to FIR?

One of the biggest pains of moving financial institutions is transferring pre-authorized transactions to your new account, but at FIR, we’ve made it easy!

With ClickSWITCH, you don’t have to go through the hassle of contacting your biller and depositors to update your account information – it’ll do it for you! ClickSWITCH can even assist you in closing accounts at your former financial institutions so you don’t have to. Simply visit an advice centre to get started!

-

How do I check my account balances?

You can check your account balances any time using online banking or the FIR mobile app.

Remember that your account balance may change during the day as transactions are processed.

Account balances are displayed as your Available Balance - this means your available line of credit will be added to the balance.

You can also check your account balance at ATMs or by calling our Contact Centre. Keep in mind, there’s a $2 fee when one of our Contact Centre advisors checks your account balance.

-

How do I change signing authorities on an account?

You need to book an appointment with an FIR advisor to change signing authority on your Community Builder or Organization account.

Bring signed meeting minutes to the appointment that indicate support for the changes you’re making. A letter signed by the signatories will also work. New signatories should bring one valid piece of government-issued photo ID with them to the appointment.

-

How do I sign up for e-statements?

Once you’ve signed into online banking, select ‘Monthly Statements’ from the menu on the left side of the screen. There’ll be a link on this page you can follow to sign up. You can also drop by an advice centre to start getting e-statements.

-

How can I print my own statement?

Once you’ve signed up to receive e-statements, you’ll be able to find your statements by clicking ‘Monthly Statements’ in your online banking. You’ll be able to view and print your statement in the same format as would be mailed to you.

-

When do I get my monthly statement?

We issue statements at different times for different members.

-

How do I order cheques?

Visit one of our advice centres .

-

What’s my route/transit number?

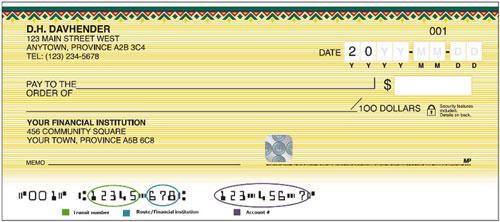

You can find your route and transit number on the bottom of your FIR cheques, as shown on the cheque image below:

The first 3 numbers on the cheque are the cheque number. The 5 digits following the cheque number are your transit number and the next 3 digits are your route number. The rest of the numbers on the cheque are your account number.

If you don’t have cheques, you can get this information through online banking by clicking the ‘Direct Deposit and Pre-Authorized Debit Form’ link.

-

When does a cheque expire?

A personal cheque expires 6 months after the date it was issued. After 6 months, the cheque becomes stale dated and can no longer be cashed or deposited.

Government-issued cheques don’t expire.

-

What are cheque holds?

When you deposit a cheque, you don’t immediately have access to the entire amount. The period of time between your deposit and when the money is available in your account is called a hold. The hold period lets us make sure the cheque clears. Holds are common for ATM deposits, but you may also notice holds on cheques deposited at an advice centre.

-

What’s an NSF fee?

If you don’t have enough money in your account to cover a cheque you’ve written or a preauthorized debit, you could be charged an NSF fee. NSF stands for non-sufficient funds.

-

How do I transfer money to another FIR member?

- You can send Interac e-Transfers† to members or non-members through online banking or via the FIR mobile app.

- If you have the FIR member’s account number, you can visit an advice centre to move the money.

-

What’s an Interac e-Transfer†?

Interac e-Transfer lets you send money to anyone with a Canadian bank account! All you need is the recipient’s email address or cell phone number so there’s no need to share account information. The transfer’s completely secure, and email and text messages are only used for updates about the transfer. Interac e-Transfer transactions can be sent from your online banking or the FIR mobile app.

Check out our advice for sending and receiving Interac e-Transfer transactions safely and securely.

-

Why can't I send or receive Interac e-Transfers†?

Keep in mind, Interac e-Transfer transactions can only be sent to someone with a Canadian bank account, and there are limits as to how much you can send within a given timeframe. See our Interac e-Transfer page for more information.

As well, make sure that you’ve left enough money in your account to cover the transferred amount as well as the $1 Interac e-Transfer fee.

-

How do I send a wire transfer?

To send a wire transfer you’ll need:

- recipient's name

- recipient’s account number

- recipient’s civic address

- recipient’s bank name and bank civic address

- applicable route and transit number of recipient’s account

For international wires, a swift code is required in addition to the above information.

-

What are my money options while I travel?

Although we no longer offer traveler’s cheques, we have a variety of other options to make sure you have the money you need when travelling.

You can order foreign cash and pick it up in an advice centre. You can also wire funds in different currencies

If you’re travelling south of the border, you can use our USD Mastercard®. All transactions are billed in USD, so you avoid paying exchange fees on every purchase.

-

What’s the annual fee for a safety deposit box?

-

What are my advice centre’s hours?

Here’s a full list of our advice centre hours, locations and contact information.

-

What are the holiday hours for my advice centre?

Our holiday hours may vary. To view a complete list of upcoming holiday hours for our advice centres and Contact Centre, visit Holiday Hours.

-

Can I still turn in pennies?

Yes! Even though pennies were discontinued by the Canadian Mint, you can still bring them into an FIR advice centre to deposit them.

-

How do I sign-up for online banking?

You can sign-up for online banking by visiting an advice centre .

-

How much does online banking cost?

Personal Online Banking is part of your monthly account service fee plan so there’s no set-up fee or extra charges to access it. There may be some regular electronic transaction fees.

If you sign up for Business Online Banking there may be additional charges.

-

What do I need to access online banking?

You’ll need to ensure you have:

- A browser that supports 2048-bit Transport Layer Security 1.0. SSL version 2.0 and 3.0 are no longer supported.

- “Cookies” enabled on your browser (check the help section of your browser if you’re not sure how to enable them).

- An accounting program, such as Quicken or QuickBooks, if you wish to download and import your account history

- An activated FIR online banking password.

-

Is online banking secure?

Yes, it’s fully secure and here are a few ways to know for sure:

- The website address will start with "https" meaning your browser is communicating with FIR’s servers over a secure connection.

- Your browser will have a closed padlock on the left or right side of the website address.

-

Can I download and import my account history into other software programs?

Yes. You can download your transaction information into several formats such as comma separated values (.csv) and portable document format (.pdf). You can also download the information into programs like Microsoft Money (.ofx), Quicken (.qfx) and QuickBooks (.qbo). Take a look at your software manual for pointers on how to download the information.

-

How do I change my online banking password?

Under the My Profile tab, click on ‘Change Password’; you’ll be prompted to answer one of your security questions. Then, you’ll enter your old password, the new password, and you’ll be asked to confirm the change.

Forgot your password? You can reset it right from the online banking password page. After an incorrect password attempt, you’ll see a link below the password field that’ll take you through the steps to reset it. We’ll ask you a few questions to verify your identity so that you can set up a new password.

-

How do I complete an online transfer between my own accounts?

Under the ‘Transfers’ tab select ‘Transfer Funds’. You’ll select the accounts you want to transfer money to and from as well as the amount of the transfer.

-

How do I pay bills online?

If you’ve already registered bills for payment with us, they’ll be accessible through the ‘Pay Bills’ tab in your online banking.

Remember to allow a few business days for the transferred money to get to the vendor's account. Some vendors take longer than others to process payments.

If you want to add or delete a vendor, click ‘Manage Payees’ in the ‘Pay Bills’ tab and then click the ‘Add a Payee’ button. You’ll need to answer a security question before proceeding.

When adding a vendor, it’s important to pay special attention to the account number and number pattern that are on the bill. If they don’t match, the payment may be rejected.

-

If I’m experiencing technical issues, who can I call for support?

For online banking technical support, questions about your account or FIR services, call our Contact Centre.

-

What’s FIR Mobile?

FIR Mobile is our mobile banking app. It lets you access your accounts and perform transactions from anywhere at any time using your mobile device.

For more information visit our FIR Mobile page. -

Is FIR Mobile compatible with all mobile devices?

FIR Mobile is compatible with:

- Android 5.0 and higher

- Apple iOS 12.0 and higher

-

Where can I download the FIR mobile app?

For more information on the FIR mobile app and instructions on how to download the app visit our FIR Mobile page.

-

What’s Deposit Anywhere?

Deposit Anywhere™ is one feature of the FIR mobile app. It lets you deposit cheques using your mobile device’s camera – and you can do it anywhere, anytime at your convenience.

-

What is Touch ID/Face ID?

Touch ID and Face ID are fast, convenient and secure ways to access FIR Mobile on your Apple device without having to type in your password. It works by using your phone’s built-in facial recognition software. This information is encrypted and stored on your mobile device – it is never shared with FIR.

When using Touch ID or Face ID to access FIR Mobile, it’s important to ensure you don’t have anyone else’s fingerprint or face scan stored on your device. This would allow them to access your mobile banking and be in violation of our Terms and Conditions.

-

What is Fingerprint Login?

Fingerprint Login is a fast, convenient and secure way to access FIR Mobile on your Android device without having to type in your password.

It works by using your phone’s built-in fingerprint sensor. This information is encrypted and stored on your mobile device – it is never shared with FIR.

It’s similar to Touch ID on Apple devices and, likewise, it’s important not to have anyone else’s fingerprint stored on your device. This would allow them to access your mobile banking and be in violation of our Terms and Conditions.

-

How do I apply for a credit card?

You can apply for an FIR Mastercard® credit card in a few ways:

- on our website

- visiting any of our advice centres

-

How do I check my Mastercard® balance?

With MyCardInfo, you can check current balances, review recent activities, verify the last payment made, make payments, view eStatements and more, on your FIRMastercard® credit card. Manage your account online 24/7 with a MyCardInfo account – free for all FIR cardholders.

-

How do I make a payment on my Mastercard®?

You can make payments on your FIR Mastercard:

- through online banking, telephone banking or the mobile app

- through MyCardInfo

- at any of our advice centres,

- through our Contact Centre

-

What’s a Mastercard® SecureCode®?

Mastercard SecureCode is a security code attached to your Mastercard account that you can use when you’re shopping online. It’s a free service offered by Mastercard Worldwide that increases the security of online transactions by adding a password to your card number.

Create your SecureCode today. Once activated, you’ll be asked to enter your card number and password each time you purchase items from participating online.

-

How do I redeem MySelect Rewards on my FIR Mastercard?

MySelect Rewards can be redeemed online through MyCardInfo. On the Account Info page, click “Browse Rewards” to get started.

-

How do I cancel my Mastercard®?

If you hold an FIR Mastercard, you can visit our advice centers to cancel your card.

-

How do I change my credit card PIN?

Once you’ve changed your PIN, you’ll need to activate it. To activate your PIN at a merchant or at an ATM, one of the following actions is required: (This is an additional security measure to ensure that your new PIN is authorized)

- When you first use your card to make a purchase, you will be required to enter your PIN three times to trigger your PIN activation. The first time you enter your PIN, the machine will advise that your PIN is invalid. You must repeat this step two more times. On the third time, the PIN will be authorized and your transaction approved. As part of the approval process you may be asked by the merchant to provide a signature on the sales slip. Your new PIN has now been activated.

- Perform a single cash withdrawal at any financial institution ATM to activate the PIN. Please note that fees may apply.

-

Where can I find an FIR ATM?

Find your nearest FIR ATM using the Find an Advice Centre or ATM section of this website or by using the Locator tool in the FIR mobile app.

-

Where can I find a credit union ATM outside Saskatchewan?

The FIR mobile app has the locations for all the ATMs in Canada that are part of the ding free® network. There are more than 1,800 ATMs in the network, and as an FIR member, you get access to all of them with no surcharges.

-

I forgot my Member Card® PIN, how do I reset it?

If you’ve forgotten your PIN, you’ll need to visit an FIR advice centre to have it reset.

-

Can I use my Member Card® debit card outside Canada?

Your card will work in some international ATMs, but it won’t work in others. Look for machines displaying the Cirrus symbol. If you’re paying at a debit machine, look for the Maestro symbol. Both symbols are on the back of your Member Card debit card.

Please note, depending on the age of your card, these symbols might look slightly different on the back of your card.

In some locations there may be limited debit access so it’s a good idea to carry a few different forms of payment. With a combination of cash, credit and debit you should be good just about anywhere you might go.

When using an international ATM, you must use a chequing account. International ATMs won’t recognize savings accounts.

-

How much are ATM fees?

There are no ATM surcharges when you use an FIR ATM or when you use an ATM in Canada that’s part of the ding free® network. There are more than 1,800 ATMs in the network and they’re easy to find with the help of the FIR mobile app.

If an ATM is going to charge an additional fee a message will appear on the screen to notify you before you accept it.

Withdrawals from ATMs that aren’t part of the ding free network will cost $2. Withdrawals at international ATMs cost $3.

-

How do I cancel or report a lost/stolen Member Card®?

Visit one of our advice centres .

If you’re calling outside of the Contact Centre’s hours of operation, you’ll have the following 3 options available:

- Press 1 to leave a message.

- Press 2 to report your Member Card debit card lost or stolen, or if you suspect fraudulent activity on your card.

- Press 3 to report your Master Card® lost or stolen, or if you suspect fraudulent activity on your card.

Lock'N'Block®

You can also “Lock” and “Unlock” your Member Card debit card on FIR Mobile or Online Banking using Lock’N’Block®, our newest fraud management tool. With a few clicks, you can set your card status to:

- Allow all transactions

- Only allow transactions in Canada

- Block all transactions

You’ll have peace of mind knowing your Member Card debit card can’t be used until you locate it (at which time you can “Unlock” your card and start using it again) or contact us and report it lost or stolen.

Access the Lock’N’Block feature in FIR Mobile under “More” or in Online Banking under “My Profile”.

-

Do I need to notify you of travel plans to ensure that my debit card will work?

It’s always a good idea to notify us of extended travel stays; this allows us to make a note on your account should there be any red flags raised during your time away.

If you’re planning a trip, talk to a representative at your advice centre .

Lock'N'Block®

You can also “Lock” and “Unlock” your Member Card debit card on FIR Mobile or Online Banking using Lock’N’Block®, our newest fraud management tool. Right now, your card is defaulted to only allowing transactions in Canada, so if you’re planning on traveling outside of the country, be sure to change it. You can access Lock’N’Block through FIR Mobile under “More” or in Online Banking under “My Profile”. With a few clicks, you can set your card status to:- Allow all transactions

- Only allow transactions in Canada

- Block all transactions

-

I just received a new Member Card® – how do I create a PIN?

If it’s a brand new card, you’ll receive your PIN in the mail 3-5 days after you’ve received your card. You can use this PIN or you can go to any FIR advice centre or credit union ATM to change your PIN.

-

How do I apply for community funding, sponsorships and grants?

You can apply for community funding, sponsorships, donations, scholarships and bursaries online.

†Interac e-Transfer is a registered trademark of Interac Inc. Used under licence.